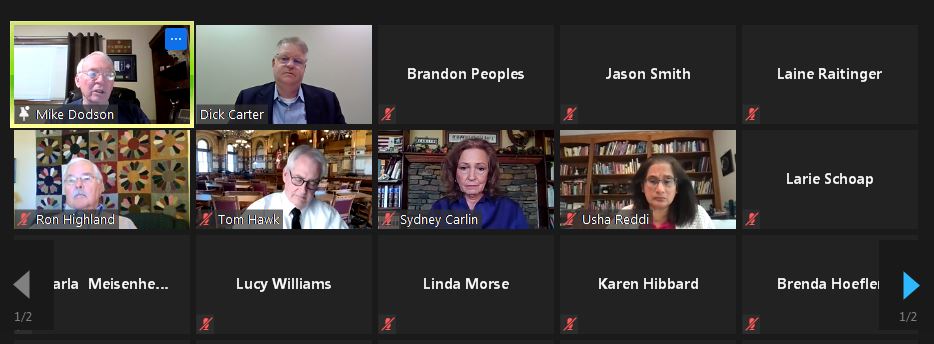

Screenshot of Friday’s virtual legislative forum, hosted by the Manhattan Area Chamber of Commerce.

Manhattan area state lawmakers fielded questions at a virtual legislative forum Friday, hosted by the Manhattan Area Chamber of Commerce.

On the topic of the legislature’s likely veto override of proposed income tax cuts in Kansas, 51st District Rep. Ron Highland (R-Wamego) says he believes it’s one of the first things the legislature will consider when veto session begins Monday.

“There are some parts of that which need to be looked at a little bit further. So I think there will be some discussion and possibly some changes in that bill. I think with some minor changes, we can get it passed easily,” Highland said.

66th District Rep. Sydney Carlin (D-Manhattan) opposed the measure despite supporting some aspects of the bill, but says she cannot support deep cuts to taxes on corporations.

“I think that corporations need to pay their fair share and in this case it was described as not so. I do think that we should decouple and allow people in Kansas to itemize their deductions,” Carlin said.

State Sen. Tom Hawk (D-Manhattan) says he’d prefer if larger companies could be decoupled from some of the tax breaks largely supported by Republicans.

“That’s a $360 million hole in the budget. These are businesses that got the loans and then loan forgiveness and then they get to deduct their expenses,” Hawk said. “I don’t think we have to give people a double dip on that. I think a single dip is probably the fairest way to go. That’s one thing that will hurt us in the next three budget years, not just this year.”

67th District Rep. Mike Dodson (R-Manhattan) says he especially likes the $100,000 threshold on internet sales tax, included within the bill.

“When you make a bill, you not only have to determine what’s appropriate but you also want to make sure you don’t engender some kind of a lawsuit later on. Even though that’s somewhat a disadvantage for some of our small, local businesses, it may be the one that can be sustained over the long term,” Dodson said.

The bill passed in March with more than the two-thirds majority necessary in the Senate, but fell three votes short of the required super-majority in the House.

Legislators were also asked for thoughts on how the Census will impact the Manhattan area when redistricting conversations begin in the coming months.

Sen. Hawk says he believes if anything changes, it could be a shrinkage in the size of his senatorial district.

“My guess is it might even just be a Riley County Senate district or certainly I would doubt it would take in as much of Clay or Geary counties, because of taking in the K-State students and Fort Riley residents,” he said.

Rep. Highland could see some dramatic changes in his district, which stretches from near the Tuttle Creek dam to northeastern Lyon County, and includes a small portion of southwestern Shawnee County. He suggested the legislature should aim at protecting incumbent districts first.

“If you do that, and draw the lines so that they are secure, then it should go real well in both the House and Senate and the governor will sign it. Now, Tom (Hawk) alluded to the fact there will be some monkey business and I believe there will be some of that tried, but if we put level heads on the committee, I think we can get around that,” he said.

Rep. Carlin suggested that, depending on census numbers, she may stand to gain some additional portions of Pottawatomie County. Carlin’s district currently encompasses primarily the city of Manhattan.

Friday’s forum also included questions regarding a framework for growth and future economic development. The full forum audio including the opening statements (segment 1) and a Q&A session (segment 2) are shared below.

The post Manhattan area lawmakers discuss tax bill, redistricting at virtual forum appeared first on News Radio KMAN.